Can XRP Hit $10,000? A Quadril...

10 February 2025 | 12:00 pm

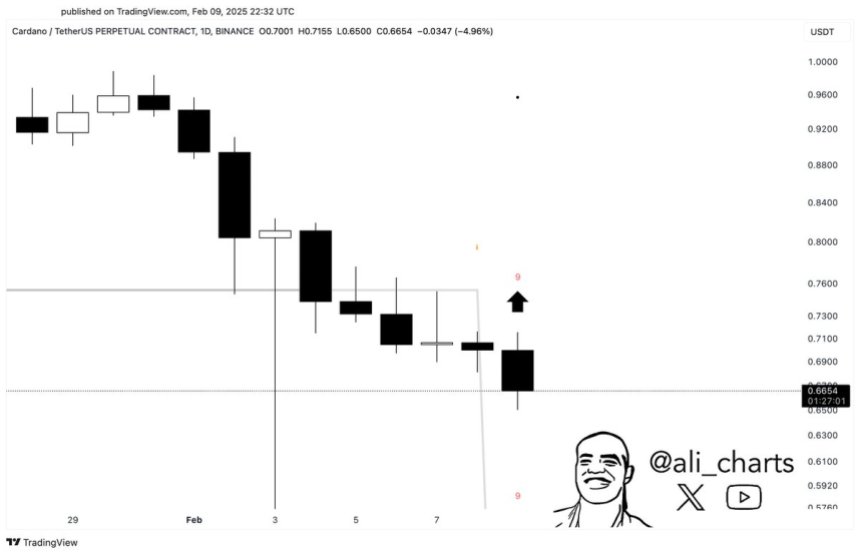

Cardano has faced significant volatility and selling pressure as the broader crypto market struggles to establish strong support levels. Since early December, Cardano has dropped over 61%, with its price action reflecting a persistent downtrend that has shaken investor confidence. Despite several attempts, the price has yet to show clear signs of reversing the bearish momentum that has dominated its performance over the past months.

Currently, Cardano is trading at a critical level, one that must hold to spark a potential change in its market trajectory. The importance of this level cannot be overstated, as losing it could lead to further declines and heightened uncertainty for ADA investors. However, hope remains on the horizon for Cardano bulls.

Top crypto analyst Ali Martinez has shared a promising technical signal, revealing that Cardano is beginning to show signs of a potential rebound on the daily chart. According to Martinez, key indicators are aligning to suggest that a recovery could be in the making, offering a glimmer of optimism for traders and long-term holders alike. The coming days will be crucial for Cardano, as it remains at a crossroads that could determine whether the current trend continues or a much-needed rebound finally takes shape.

Cardano could be on the verge of a recovery rally as it finds strong demand at current levels, with bears unable to push the price into lower demand zones. After months of persistent selling pressure and bearish sentiment, Cardano appears to be stabilizing, creating an opportunity for bulls to regain control. However, reclaiming key levels above the $0.72 mark will be critical to confirming the start of a meaningful recovery.

Adding to this optimism, top analyst Ali Martinez recently shared a technical signal on X, indicating that Cardano may be poised to rebound. Martinez highlighted that the TD Sequential indicator has flashed a buy signal on the daily chart, a development that has caught the attention of many ADA investors. The TD Sequential is a widely used technical analysis tool designed to identify potential price reversals and points of trend exhaustion, making it a valuable indicator during volatile market conditions.

This positive signal offers a glimmer of hope for Cardano investors who have been waiting for a rally, not just for ADA but also across the altcoin market. If bulls can hold the current demand level and push the price above $0.72, a recovery rally could gain momentum in the coming weeks.

Breaking through this key level and sustaining higher prices will likely attract more buyers and fuel bullish sentiment, potentially marking the start of a new upward trend. However, failure to reclaim key levels could result in extended consolidation or further declines, making the next few days crucial for Cardano’s price trajectory.

Cardano (ADA) is currently trading at $0.69 after enduring days of selling pressure and heightened volatility. Last Monday’s dramatic 38% drop, followed by an impressive 60% recovery, showcased the intensity of the current market conditions. However, despite the swift rebound, ADA has struggled to reclaim the $0.85 level, a critical resistance zone that bulls must conquer to establish a sustainable uptrend.

For Cardano to gain momentum, it is essential for bulls to hold current price levels and push the price above the 200-day exponential moving average (EMA), which stands at $0.7225. This EMA serves as a crucial indicator of long-term strength, and a reclaim above it would signal renewed bullish momentum. Breaking above this level could pave the way for a rally, potentially bringing ADA closer to challenging the $0.85 mark again.

Failing to hold the current price or reclaim the 200-day EMA could lead to further consolidation or even another leg down, as market sentiment remains fragile. The coming days will be critical for ADA as it tests its ability to maintain support and establish a bullish trend. Investors will closely watch these key levels, as holding and breaking above them could signal the start of a recovery rally.

Featured image from Dall-E, chart from TradingView