Amazon, Inc. (AMZN) Stock: Pri...

3 April 2025 | 12:18 am

Binance’s CEO Changpeng Zhao (CZ) has announced the burning of approximately $600 million worth of Binance Coins (BNB). The latest development is in line with the company’s crypto burning program. The quarterly event reduces the number of BNB coins in circulation, thereby bringing down inflation and increasing demand for the remaining coins. The strategy has historically led to price hikes.

The company is already committed to burning 100 million coins. Since January, the coin has surged by over 1,200 percent, and it looks as though it’s headed to greater heights.

The Tesla Share Token

Binance recently unveiled its Tesla share trading service. To many, it is one way through which the crypto community can appreciate the boost from CEO Elon Musk, who has so far invested over a billion dollars in the market through bitcoin. It, however, also gives international users without access to US markets the opportunity to trade the stock. Ultimately, the incursion of Tesla Stock traders will provide greater exposure to Binance native coins such as the Binance USD (BUSD) and BNB, which are regularly used by clients to lower platform trading fees.

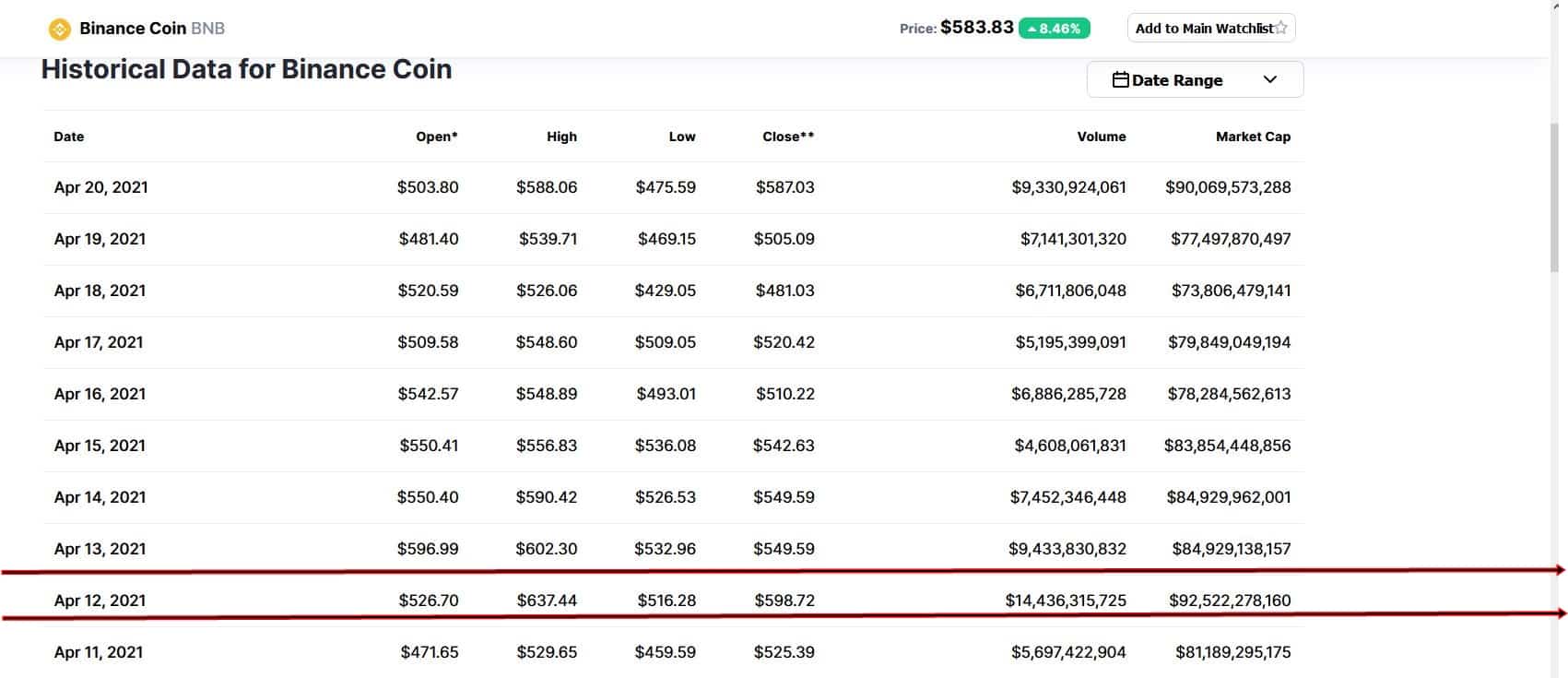

This ancillary benefit was demonstrated during the April 12 Tesla Token launch. The event caused Binance Coin to surge by over 25 percent within 24 hours, to peak at $637.

Data from CoinMarketCap corroborates the demand increase. It shows an escalation of BNB trading volume, reaching an unprecedented $14 billion. The momentary price spike caused BNB to surpass XRP in market capitalization after achieving a valuation of approximately $92 billion dollars.

Data from CoinMarketCap corroborates the demand increase. (Image Credit: CoinMarketCap)

The Bitcoin Factor

Another factor that will ultimately contribute to a BNB price hike is the growing Binance userbase which has increased significantly this year thanks to the staggering bitcoin uptrend.

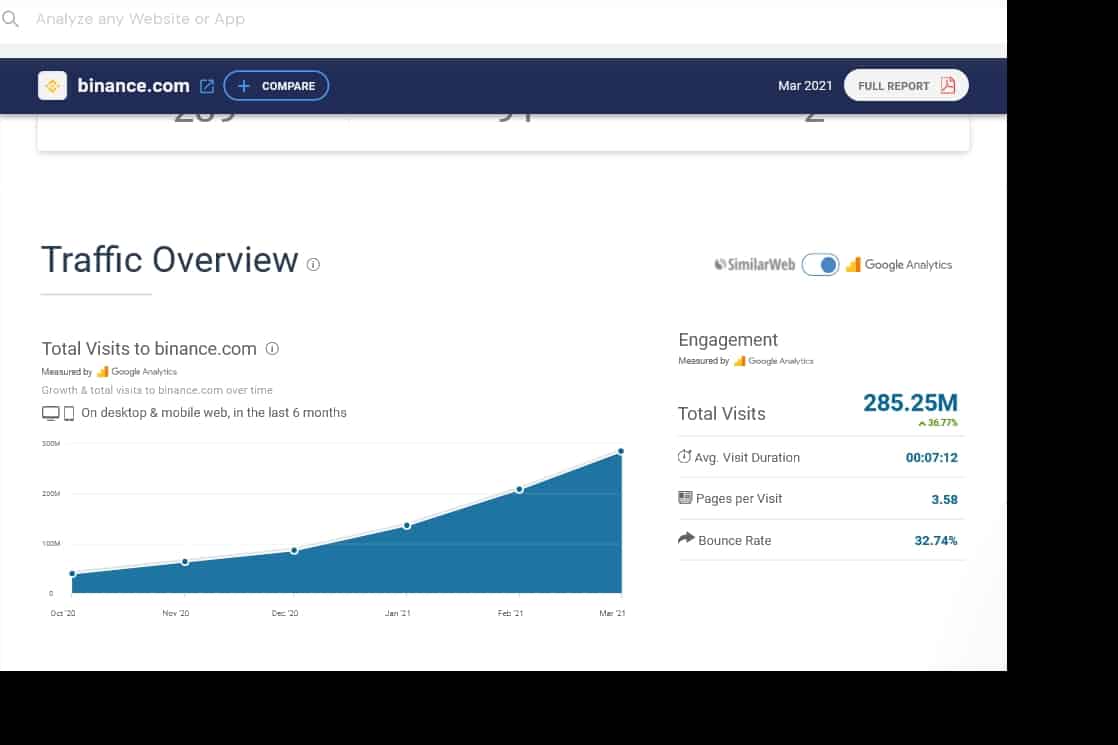

According to data from SimilarWeb, traffic on the Binance has swelled from 39 million monthly visitors to 285 million in just six months as a result. That is an over 700 percent increase. The additional traffic allows Binance to expand its product range and scale its services. It triggers a snowballing effect that will lead to greater demand for its native platform coins, such as BNB.

Traffic on the Binance has swelled from 39 million monthly visitors to 285 million. (Image Credit: Similarweb)

The Binance Smart Chain

The Binance Smart Chain has recently been gaining traction, thereby contributing to BNB’s rise. Unveiled in September 2020, it supports smart contracts and staking of BNB coins.

The blockchain’s scalability, as well as low transaction fees, means that it is now being used by more DeFi projects. The latest adopters include Value DeFi, Harvest Finance, and PancakeSwap, and they have brought millions of users on to the system.

The BSC protocol validates BNB as a proof of stake cryptocurrency, thereby contributing to its popularity.

Direct Promotion from Binance

Binance has been promoting the use of BNB coin on its platform for some time now. It presently encourages the use of the coin to pay platform fees, including on Binance DEX, by offering a 25 percent discount. It has also placed it on the Binance Earn program, which allows crypto users to earn passive income by staking cryptocurrencies.

Lastly, the Binance Card powered by Visa can be topped up using BNB coins besides Bitcoin. Customers can use the card to make online shopping and regular bill payments. Over 35 million vendors worldwide accept BNB card payments, and this increases its use cases.

The post Why BNB Coin Price is Likely to Rise in the Medium Term appeared first on CoinCentral.