Bitcoin (BTC) Nears $100K Amid...

27 November 2024 | 1:10 am

The Dogecoin price has been gearing up for a major bull rally since it rose to the $0.4 threshold and began testing this resistance. Shedding light on Dogecoin’s future bullish trajectory, a crypto analyst has discussed the importance of the $0.22 50-day Moving Average (MA) in determining the Dogecoin price movements in this bull cycle.

The 50-day MA is a technical indicator that highlights a cryptocurrency’s average price over the last 50 trading days. It is primarily used to identify price trends, determine resistance and support levels, and generate buy and sell signals.

Kevin, a crypto analyst on X (formerly Twitter), has underscored the significance of this critical technical indicator in the recent Dogecoin price movements and its influence on the meme coin’s future bull rally. The analyst disclosed that historically, during Dogecoin’s previous bull markets, its price consistently stayed above the 50-day MA, never losing this crucial threshold despite testing it multiple times. Typically, staying above the 50-day MA is seen as a bullish indicator, while consistently dropping below this average suggests a downtrend.

Presenting a detailed chart of Dogecoin’s price action in the last bull cycle in late 2020 to date, Kevin disclosed that the current 50-day MA for the meme coin is at $0.22. However, this price threshold is rising quickly as Dogecoin closes each daily candle.

Additionally, the rapid increase suggests that if Dogecoin can remain steady around or above the 50-day MA, its price should see a significant bullish trend continuation, providing a strong foundation for even higher prices.

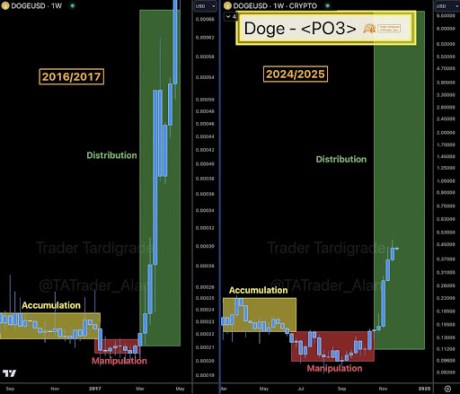

In a different X post, Trader Tardigrade, a prominent crypto market expert, declared that Dogecoin has officially entered the Distribution phase in the classic Power of Three (PO3) market cycle. The PO3 cycle is a popular concept in technical analysis used to identify key market phases — Accumulation, Distribution, and Manipulation.

With Dogecoin now firmly in the Distribution phase, large holders may be offloading their assets, potentially locking in profits following DOGE’s recent price increase. While the distribution phase could be seen as the end of a bull rally characterized by sell-offs and slow momentum, Trader Tardigrade believes that this phase could be calm before a massive price surge.

The analyst shared two price charts comparing Dogecoin’s movements during the bull cycle between 2016 and 2017 and its future price action in 2024 and 2025. In the 2017 bull market, Dogecoin entered a distribution phase, which led to a significant bull rally to new levels above $0.00066.

If this trend holds true for Dogecoin’s current distribution phase, Trader Tardigrade has predicted that its price could surge as high as $9.5 from its current value of $0.4.