Analysts: Gold Transactions Fu...

29 November 2024 | 1:04 am

The crypto sector offers an abundance of trading platforms and cryptocurrency exchanges to buy, sell, and trade crypto assets. The Balancer decentralized exchange (DEX) might be a fairly new addition to the bunch, but it has become a market leader with its innovative multi-token pools, which are great options for traders and liquidity investors. Read on our Balancer app review to learn everything you need to know about Balancer’s offerings, brief history, Balancer features, trading fees, Balancer pros, cons, and determine if its trading platform is a good fit for you.

Let’s dive in!

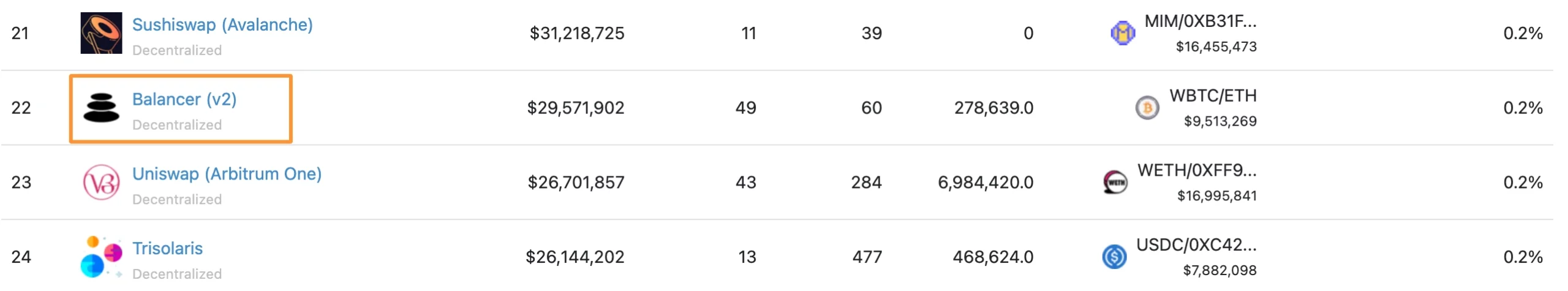

The Balancer platform was launched in March 2020 by Mike McDonald and Fernando Martinelli. The exchange quickly gained popularity among traders and investors, making Balancer one of the top DEX platforms in terms of both trading volume and locked value. The Balancer DEX is currently ranked #22 by trading volume among decentralized exchanges on the coin tracking platform CoinGecko.

Additionally, it’s the 5th largest DEX by total value locked (TVL), according to DeFi tracking website DeFiLlama.com.

Despite the recent ubiquitous crypto decline, Balancer Protocol TVL stood at 2.83 billion in Feb 2022.

Balancer is built on the Ethereum blockchain and offers ERC-20 token trading exclusively in a trustless, permissionless environment. Unlike centralized exchanges, Balancer provides an open and accessible platform, and all you need for trading is a valid wallet.

The Balancer DeFi platform has wide functionality. It allows users to trade cryptocurrencies and generate income by staking BAL tokens and earning rewards. It’s also a liquidity provider and features automatic portfolio management of ERC-20 tokens. The goal of Balancer is to provide a flexible platform for programmable liquidity. In Balancer, instead of paying fees for portfolio managers to use rebalancing strategies and actively manage the fund, the pool balances itself. Smart pools can be created which are controlled by a smart contract. Let’s take as an example the liquidity bootstrapping pool (LBP) template by the Balancer team, which serves to create deep liquidity for a new token issue without expensive market making. Liquidity pools and complex algorithms are used to price assets and allow trades to take place without requiring centralized permission.

Like most decentralized exchanges, the Balancer protocol doesn’t support fiat trading. i.e., you cannot deposit your funds in fiat currencies and cannot trade them for ERC-20 tokens on the platform. Instead, you can deposit funds from a pre-existing crypto wallet, which we’ll discuss later.

Balancer has a native token, BAL, dubbed the Balancer token, with a broad utility on the platform.

Now, let’s dive deeper into the Balancer Protocol’s core features and why liquidity providers and traders might choose the platform over other similar DEXs.

Balancer offers several key advantages to traders and investors alike that helped the platform move up the ladder and gain popularity.

Balancer offers the following perks to investors:

Trading on Balancer is fast and easy for everyone involved. Users can exchange any amount of ERC-20 tokens without authorization, which many other platforms require. Instead, the Balancer protocol is an open crypto marketplace that provides users access to real-time price data without compromising security.

Additionally, trading on Balancer has several key benefits:

The Balancer CoWSwap Protocol (BCP) is the default trading interface on the Balancer app, enabling users to benefit from free signature trades.

DEX traders often face price slippage and increased gas costs if an exchange does NOT feature MEV protection.

Traders don’t have to give control of their assets to a middle man. The exchange enables transactions on a full peer-to-peer basis.

To help Balancer users get the most out of their trading experience, Balancer offers five key products thoroughly described on the website.

The Vault is like the brain or the Treasury of the protocol. It’s a smart contract that stores all tokens in liquidity pools. Users may store Internal Balances in the Vault and make trades to and from these balances. The Vault is one of the most crucial parts of the system and also acts as a gateway for all transactions carried out on the platform.

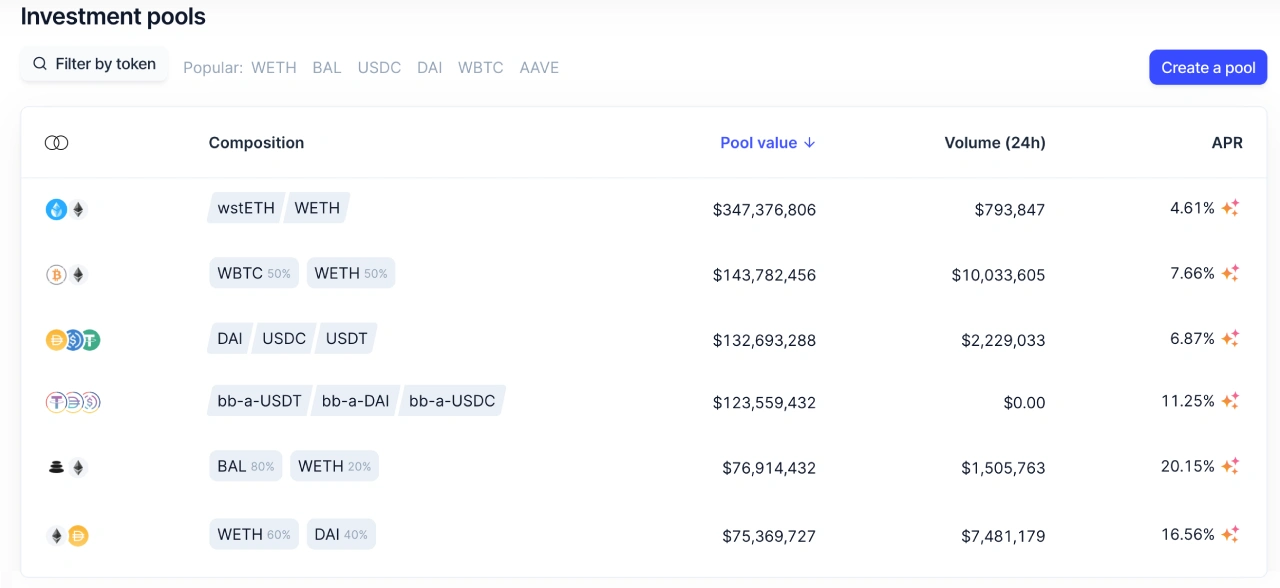

Balancer pools have high versatility as compared to many other DEXs. The protocol supports pools with any composition and underlying math. Any user can build their own pool, which results in flexible pricing options and functions.

The following pool choices are available on the Balancer Protocol for various token combinations: Weighted Pools, Stable Pools, MetaStable Pools, and Liquidity Bootstrapping Pools.

Smart order routing is a system through which traders can discover the best pricing for their desired swap. The price sensor increases in confluence with the diversity rise within the Balancer Pools. So when Balancer users create more pools with unique configurations, it enriches the SOR and develops it further.

The Orchard allows traders to claim the tokens from the contracts. Claiming digital assets via Merkle Orchard traders save on gas fees, especially when they wish to claim a few weeks’ worths of rewards and/or multiple tokens.

The BGP is the default protocol on the Balancer app. The system provides access to other DEXs to make sure traders get the best possible price. It’s connected to the Vault, which makes sure BGP can manage small transactions with minimal trading fees.

You have probably already decided whether you want to register on Balancer or not. If you choose to go for it, read on to learn how to start trading on the Balancer Exchange!

Trading on Balancer Platform doesn’t require KYC (know your customer) verification, and you can start trading straight away if you already have a cryptocurrency wallet. The platform doesn’t support fiat transactions, so you can’t connect your account to a credit/debit card or your bank account.

Connecting your wallet to the Balancer is easy and convenient. The platform gives you four options to choose from. The Metamask wallet, one of Ethereum’s leading wallet options, is the most popular option you can use with Balancer.

Wallet Connect, Portis, and the Coinbase wallet are also available. It’s worth noting that, Coinbase is the largest centralized exchange in the US and allows fiat deposits. If you are new to crypto and the Balancer, a Coinbase wallet is a great shortcut. Open a Coinbase account, deposit your fiat onto Coinbase, buy any ERC-20 token as a fiat pair, then access your wallet through Balancer.

Like most other trading platforms, Balancer offers a Trading View chart for your convenience. It allows you to keep track of the tokens you wish to acquire or sell in real-time. Moreover, it’s fairly comfortable for beginners and experienced traders alike.

The Balancer pools are customizable; the fees would vary from one pool to another. The Pool developer is responsible for setting the fee they feel appropriate, with a resulting wide range from 0.0001 – 10%. However, the automated market maker tool Smart Order Router considers the fees before offering the best deal possible to traders.

Each trader participating in a pool pays Swap Fees. These fees generally go to LPs (liquidity providers) in exchange for depositing their tokens into the pool to facilitate the trades, i.e., provide liquidity. The fees are collected immediately after the swap, growing the pool’s balance. The fee also depends on the amount of the tokens. The following formula reflects the Balancer fee policy clearly:

The formula acts as a way to keep the LPs proportion in the pool the same while the pool itself grows.

In V2 Balancer, a small protocol fee is also charged, which is a percentage of the swap fee. V2 Balancer has also created dynamic fee pools that maximize returns for LPs. Additionally, the Balancer website contains detailed information about the exchange’s trading fee system and could answer all the additional questions.

Tokenization is a popular way for DEXs to organize and implement the governance feature, and Balancer is not the only one to take that route. Members of the community who own BAL tokens can vote on proposals concerning the platform and the vector of its development. Traders on Balancer earn BAL tokens by providing liquidity, which they later utilize for Balancer Governance. Moreover, the governance vote constitutes the final authority, which cannot be overruled. Balancer claims it’s an open, transparent, and intuitive protocol that wants to advance “openly and honestly.”

The Balancer governance votes take place on Snapshot, a platform that provides off-chain and gas-fee opportunities to hold votes, producing easily verifiable results. Additionally, the Governance votes have the authority to change protocol fees charged on the platform and choose how those fees should be spent to promote Balancer better.

Balancer is a DEX, so it doesn’t need any verification of your identity when it comes to privacy. While Coinbase might require a valid ID, photograph, and phone number for large trades, Balancer needs only a valid wallet. Furthermore, there are no backdoors or admin keys on Balancer Labs, which makes the platform trustless. The absence of a middle man also means the Balancer itself doesn’t have any control over the assets in the liquidity pools. Instead, it uses smart contracts to control the exchange. However, Balancer’s smart contracts do carry risks, which any trader should consider before signing up to trade with any centralized or decentralized exchange.

When it comes to flawed tokens, Balancer has a way of scanning the pools, dubbed “Configurable Rights Pools.” The system makes sure that all tokens interact with the pool securely. Yet, the risk of having a scam token is still there, as DEXs have a token listing procedure different from CEXs.

As mentioned earlier, bug bounties are a common practice on Balancer. As the DEX is entirely controlled by smart contracts, finding flaws in the contracts and eliminating them increases security and cuts the chances of potential malfunctions. The Balancer Labs offers rewards for bugs, but it also has rules: “Only the first reporter of a given contract vulnerability will be rewarded, and findings already discovered as part of a formal audit are ineligible,” reads the announcement.

DEXs often don’t have centralized customer support. Instead, they have active communities that can answer all the pending questions and help with anomalies or problems that might occur. Likewise, there’s an active Balancer community on multiple social media sites, including LinkedIn, Twitter, Medium, and Github. Depending on the issue, you can choose the corresponding channel.

In a short span of time, Balancer became one of the most used platforms allowing you to trade and invest trustlessly and permissionlessly.

Like many other DeFi apps, Balancer makes transactions through liquidity pools and chooses whichever will secure the best rate for the customer. The platform accommodates ERC-20 token trading only, so you cannot trade other tokens or fiat currency. All you need to do is connect to your pre-existing crypto wallet and start trading.

Balancer allows US investors to participate in the liquidity pools. However, due to strict regulations within the United States, DEXs could get in trouble for trading’ unregistered securities’. That’s the main reason behind many exchanges being unavailable in the US. The Securities and Exchange Commission, the law enforcement agency that deals with securities trading and registration within the country, is responsible for monitoring all crypto exchanges.

However, as mentioned, Balancer is not on the naughty list.

BAL is the governance token on Balancer Protocol, offering holders the opportunity to vote on any community decisions. Balancer users can get BAL tokens in exchange for becoming a Liquidity Provider and locking funds in a liquidity pool.

You can trade Wrapped Bitcoin (WBTC), which is a token “adjusted” for trading on Ethereum-based decentralized apps. It has the same value as BTC and can be traded on Balancer, among other Ethereum-based dApps.

The Balancer Ecosystem Fund is currently valued at over $100M, and a total of 5M $ BAL tokens have been set aside for strategic partnerships.

Investment advice Disclaimer:

This content, including any information contained therein, is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument mentioned in the content. Retail investor accounts should carefully consider all the aspects before investing.