Crypto Regulatory Developments...

17 February 2025 | 2:14 pm

The post SUI’s Bullish Divergence Points to a 30% Rally appeared first on Coinpedia Fintech News

During the recent price drop, only a few cryptocurrencies have managed to resist a massive decline, and SUI, the native token of the Sui blockchain, is one of them. The asset’s daily chart shows that SUI has remained above the crucial support level of $3 and the 200 Exponential Moving Average (EMA).

With the recent retest of this support level, expert analysis suggests that SUI appears to be forming a bullish double-bottom price action pattern, and the price has started moving upward. However, the daily chart not only signals a bullish pattern but also shows a bullish divergence, indicating that the asset may soon experience a massive upside rally.

Based on recent price action, if SUI holds its support level, it could soar by 30% to reach the $4.15 level in the near future.

In addition to this prediction, the bullish thesis will remain valid only if SUI’s price stays above the $2.97 level, otherwise, it may fail.

SUI is currently trading near $3.18 and has experienced a price surge of over 7.50% in the past 24 hours. However, during the same period, bullish price action has driven increased participation from traders and investors, resulting in a 15% jump in trading volume.

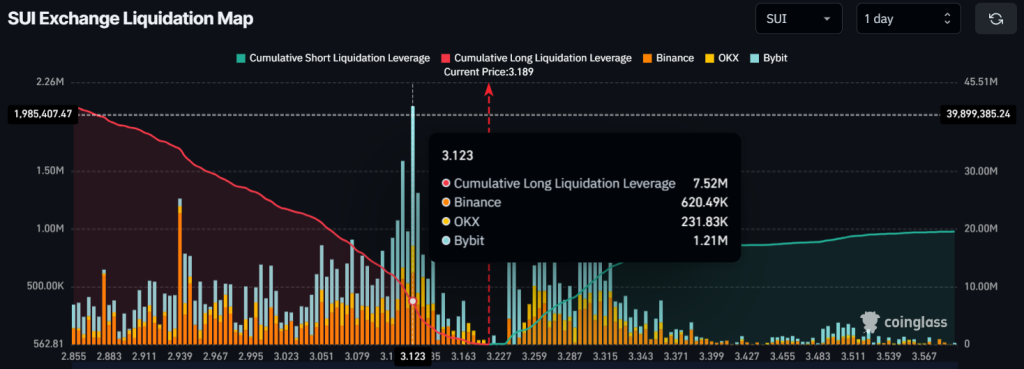

During this surge in participation, investors and long-term holders have been significantly accumulating the asset, as reported by the on-chain analytics firm Coinglass.

Data from spot inflows and outflows revealed that exchanges have witnessed an outflow of a significant $21 million worth of SUI tokens, indicating potential accumulation.

In this ongoing price recovery, market sentiment remains positive, as investors and analysts see this as a bullish sign that could drive buying pressure and further upside momentum.

Apart from the bullish participation of investors and long-term holders, intraday traders also seem to be following the same trend.

Data reveals that traders betting on the long side are over-leveraged at $3.123, having built $7.55 million worth of long positions at that level, as they believe the price won’t fall below it.

Conversely, $3.26 is another over-leveraged level, where traders betting on short positions have accumulated $5.20 million worth of short positions.

This on-chain data suggests that bulls, including traders and investors, are currently supporting the price action and could help the asset soar significantly in the coming days.