Bitcoin (BTC) Nears $100K Amid...

27 November 2024 | 1:10 am

Nasdaq-listed company Microstrategy has avoided a “multi-billion dollar mistake” by choosing to invest in bitcoin instead of gold. The company now holds about 108,992 bitcoins.

The Nasdaq-listed software company Microstrategy has avoided making a mistake that could have cost the company multi-billion dollars. CEO Michael Saylor tweeted Sunday:

If I had chosen gold instead of bitcoin last year, it would have been a multi-billion dollar mistake. It doesn’t help to diagnose the problem if you don’t choose the right solution.

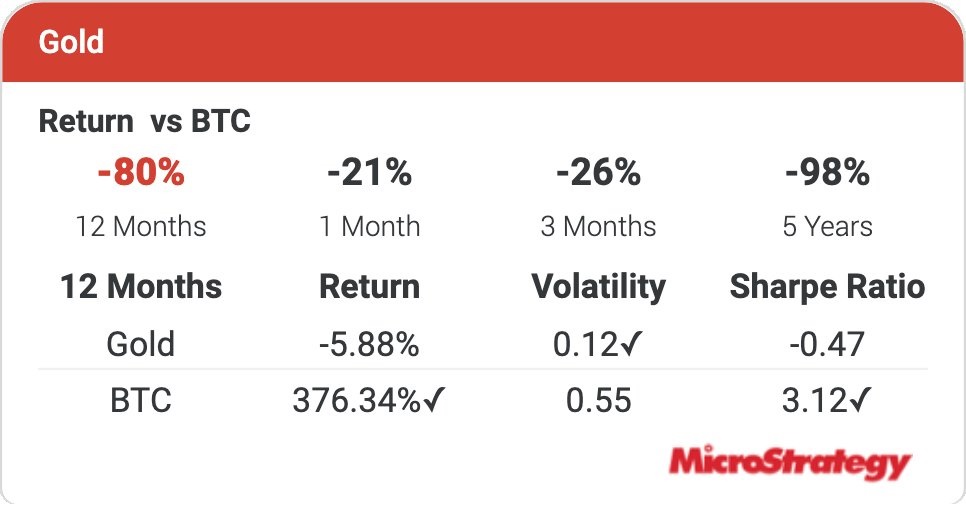

The CEO also posted the return of gold vs. bitcoin. According to his estimation, gold returned -5.88% during the past 12 months while bitcoin returned 376.34%. In addition, the return of gold vs. bitcoin was -80% during the last 12 month period.

Microstrategy has made acquiring bitcoin one of its primary goals. The company now hodls about 108,992 BTC.

Saylor said earlier this year: “Gold is dead money. Sell your gold, buy bitcoin because other people are going to sell their gold and if you wait until you’ve been front-run by all the hedge funds when they dump their gold, you’re going to be the last person out.”

In April, Saylor and Frank Giustra debated about bitcoin vs. gold. The Microstrategy CEO explained at the time that “Diversification makes no sense when there’s a cracked answer to an engineering problem.” He opined: “You will never diversify the metal in an aircraft wing, or the answer to a math problem, or the shape of the ship’s hull, or the oxygen content in a scuba tank. When the cabin depressurizes, you don’t place an oxygen mask on 10% of your family. Money is a winner-take-all competition. There is an answer. Choosing the wrong answer has dire consequences.”

Investors have been increasingly buying bitcoin as an alternative to gold. A survey by UBS, Switzerland’s largest bank, finds that central bankers see benefits in investing in cryptocurrencies like bitcoin. Among respondents, 28% see cryptocurrency as an uncorrelated asset, and “11% would consider it as an alternative to gold.”

What do you think about Microstrategy avoiding a multi-billion dollar mistake by choosing to invest in bitcoin instead of gold? Let us know in the comments section below.