Analysts: Gold Transactions Fu...

29 November 2024 | 1:04 am

Uniswap is an innovative decentralized exchange protocol built on Ethereum. It aims to solve decentralized exchanges’ liquidity problem by allowing the exchange platform to swap tokens without relying on buyers and sellers creating that liquidity. Uniswap incentivizes Uniswap users to maintain the exchange’s liquidity, providing portions of the transaction fees and newly minted UNI tokens to those who participate.

UNI is the token for Uniswap. It’s a governance token, so owners can participate in decisions on network upgrades and policies, with each vote being proportional to the amount of UNI cryptocurrency they stake.

Read on to learn everything you need to know about the Uniswap project, the UNI token, and how to start investing in UNI.

Uniswap is a decentralized exchange or DEX working on the Ethereum blockchain. It was launched in 2018 and is the second-biggest cryptocurrency program in terms of market capitalization globally.

Uniswap is an Automated Liquidity Protocol for trading ERC20 tokens. In contrast to other exchanges, which take trading charges, Uniswap works for public welfare. It allows users to exchange tokens without any intermediaries, achieving a high level of decentralization.

Uniswap operates via contracts built into its protocol and utilizes an introductory numerical statement and supplies of ETH and tokens to do a similar task.

The protocol relies on liquidity providers creating liquidity pools that provide liquidity across the platform, allowing users to seamlessly swap between essentially any ERC-20 tokens without the need for an order book.

In contrast to a centralized exchange, there is no listing process on Uniswap. Any ERC-20 token can be launched for trading on the Uniswap platform as long as a liquidity pool is available. Uniswap does not charge any listing fees, making it essential for new or smaller ERC-20 projects.

Uniswap allows users to retain control of private keys, eliminating the risk of losing assets if the exchange is ever hacked.

Uniswap charges users a flat 0.30% fee for every trade on the platform and automatically sends it to a liquidity reserve.

When a liquidity provider exits, they receive a portion of the total fees from the reserve relative to their staked amount in that pool.

After the Uniswap v.2 upgrade, a new protocol fee was introduced that can be turned on via a community vote and sends 0.05% of every 0.30% trading fee to a Uniswap fund to finance future development. Currently, this fee option is turned off; however, LPs will start receiving 0.25% of pool trading fees if it’s turned on.

Uniswap does not follow the centralized exchanges’ conventional engineering of advanced trade and works without an order book. It uses Constant Product Market Maker design, a variation of a common decentralized exchange model known as Automated Market Maker (AMM).

AMM are smart contracts that hold liquidity pools (reserves) that traders can exchange in trades. These pools are funded by incentivized liquidity providers.

Anyone who lends an equivalent value of two tokens in the pool is a liquidity provider. In return for their stake in liquidity pools, traders pay a fee to the pool distributed to liquidity providers according to their share of the pool.

These tokens can either be an Ethereum token and any ERC-20 token or two ERC-20 tokens. These pools are made up of stablecoins such as USDC, DAI, or USDT, yet this isn’t mandatory. LPs are rewarded with liquidity tokens based on their share of the entire liquidity pool.

Uniswap (UNI) is the asset that powers Uniswap. Its primary use case is as a governance token. Uniswap (UNI) tokens enable a decentralized payment method, providing more control over your money. UNI can also be used for speculation, investment, or as an alternative to expensive and slow international transfers. It can also contribute to an alternative financial system for people with access to smartphones but not a bank account.

If you have Ethereum or some other type of ERC-20 token in your wallet, you can trade on Uniswap through its app right now.

Otherwise, you can buy UNI on cryptocurrency exchanges using the same method as any other ERC-20 token. Follow the easy steps described below:

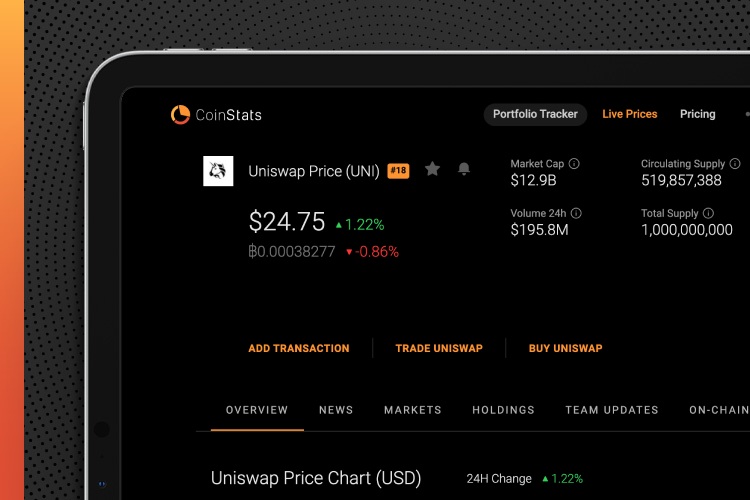

CoinStats is one of the best crypto platforms around. It allows you to check current market prices, along with in-depth information on several of the biggest and fastest-growing cryptocurrencies.

CoinStats is a cryptocurrency research and portfolio tracker app that provides valuable information on cryptocurrency news and investment advice to help investors make better decisions.

To buy UNI on CoinState, all you have to do is create an account on the platform. This is a simple, straightforward process. Once your account has been created, go to the search section and enter UNI. From here, you can easily make trades and swap tokens.

In addition, guides and educational blog posts such as UNI price or how-to-buy guides like how to buy cosmos, how to buy AAVE on Coinstats, and much more are highly recommended for investors.

In addition to the information on Uniswap described above, there are a few more factors to consider before buying Uniswap (UNI):

Uniswap rewards users who lend their crypto to ensure there are sufficient funds in its liquidity pools.

When adding liquidity, you need to contribute equivalent amounts of both cryptocurrencies to the pool. In return for your contribution, Uniswap will pay you a share of the gas fees for that liquidity pool.

The idea is that users can earn tokens in exchange for providing the liquidity necessary to facilitate trades of a specific token pair on the platform.

Crypto assets are highly speculative, involve a high degree of risk, and can lose their value rapidly and significantly in the future.

So, make sure you understand the risks involved before buying Uniswap. Another potential problem with crypto trading is that regulators may try to put down decentralized finance, DeFi as a whole, which could negatively affect Uniswap.

This content and any information contained therein is intended for informational and educational purposes only, does not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument referenced in the content, and does not constitute investment advice, financial advice, trading advice, or any other advice.

After the purchase of your tokens, you’ll need to decide how to use them. You have three options: to hold, sell, or trade.

You have two options for selling your Uniswap tokens:

To trade tokens on Uniswap, follow these steps:

The Uniswap project’s decentralization and open governance through its UNI token make it very popular. Uniswap’s liquidity pools are also attractive for investors who want to earn income on cryptocurrency staking. AMM procedures on Uniswap are permissionless, meaning there are no requirements to fulfill KYC criteria and no cyber attackers. Uniswap is user-friendly – the only thing you need to trade is an Ethereum wallet. Last but not least, there is no need to pay for token or coin listing tax.