Analysts: Gold Transactions Fu...

29 November 2024 | 1:04 am

Bitcoin Gold (BTG) is one of the first major hard forks of Bitcoin. It was founded in 2017, attempting to be more decentralized than Bitcoin.

BTG aims to democratize the mining process and make it more accessible to everyday users by removing the need for specialized mining equipment.

Read on to learn everything you need to know about Bitcoin Gold, holding Bitcoin Gold, or how to buy and trade it.

Bitcoin Gold (BTG) is a cryptocurrency created from a hard fork of Bitcoin (BTC). Bitcoin Gold officially split from the original Bitcoin blockchain on October 24th, 2017.

The purpose of the Bitcoin Gold project was to restore the original decentralization of Bitcoin mining. In the early days, Bitcoin (BTC) could be mined using regular computers. However, as the network has grown, the only way to profitably mine BTC is to use ASICs (application-specific integrated circuits). With the use of ASICs, Bitcoin mining has become monopolized. Big companies control most of the network hash rate, which gives them the power to revise transaction history and prevent new transactions from being confirmed.

Jack Liao, CEO of the Hong King-based mining company Lightning ASIC, first announced the Bitcoin Gold project in July 2017. Bitcoin Gold changed Bitcoin’s proof-of-work (PoW) algorithm to create a digital asset that didn’t require ASICs for mining. Instead, Bitcoin Gold used GPU (graphics processing unit) mining, making it more accessible and restoring decentralization in the network.

After officially launching on November 1st, 2017, community members criticized the development team after finding that 100,000 BTG coins had been pre-mined. The team said that the pre-mined funds would be used to support the growth of the Bitcoin Gold ecosystem, and five percent were set aside as a bonus for the team.

The official Bitcoin Gold website was compromised in that same month, and more than $3.3 million were stolen in this scam.

In May of 2018, Bitcoin Gold was hacked by attackers. The hackers stole more than $18 million in BTG from multiple exchanges, including Bittrex.

Hoping to prevent future attacks, in June 2018, the Bitcoin Gold project changed their proof-of-work (PoW) algorithm from “Equihash” to a new hashing proof-of-work algorithm, called “Equihash-BTG.”

BTG algorithm is ASIC resistant, so you can mine it yourself if you have a powerful computer. You can also increase your earnings by joining a mining pool.

It is possible to purchase Bitcoin Gold with a Regulated Broker and on a variety of exchanges. You can choose a cryptocurrency exchange that best suits your needs on the official Bitcoin Gold website.

Before registering with an exchange, consider checking if it’s available for cryptocurrency trading in your country.

Some offer to exchange national fiat currencies such as US dollars for Bitcoin Gold, while others only exchange for Bitcoin or Ethereum.

If you want to buy Bitcoin Gold with fiat currencies, CEX.IO might be the right choice for you. It’s one of the only exchanges that allow you to purchase Bitcoin Gold with USD. If you previously owned Bitcoin, all you need to do is register in CEX.IO, confirm your account, and search for BTG/USD.

Other exchanges that support Bitcoin Gold with fiat currencies include YoBit and DSX.

Another easy way to buy Bitcoin Gold is via Contract for Differences (CFD’s). If you are interested in buying it as a CFD, consider using a broker who offers a wide range of payment methods, including credit card, wire transfer, etc. The broker allows you to purchase cryptocurrencies with a leverage position in a relatively simple process.

For those looking to buy Bitcoin Gold with digital currencies, you will need to go through an exchange that supports the BTG/BTC or BTG/ETH pairing with which you are looking to buy Bitcoin Gold coins.

Follow our step-by-step guide to buy BTG:

Step #1: Open an account on an exchange that supports BTG: Most exchanges require an email address, phone number, and proof of ID to register.

Step #2: Identity verification: Some platforms use 2-factor authentication. You will be required to provide some valid means of identification for a standard KYC procedure.

Step #3: Deposit funds into your account: Fund your account with a bank transfer, pay with a credit or debit card or deposit cryptocurrency from a crypto wallet to buy Bitcoin Gold.

Step #4: Buy Bitcoin Gold. Complete your purchase.

Step #5: Acquire a wallet: Consider moving your coins to a hardware wallet for safety. Only wallets, like the Ledger Nano, etc., offer you long-term secure storage.

To sell Bitcoin Gold, you need to transfer BTG from your wallet back to exchange.

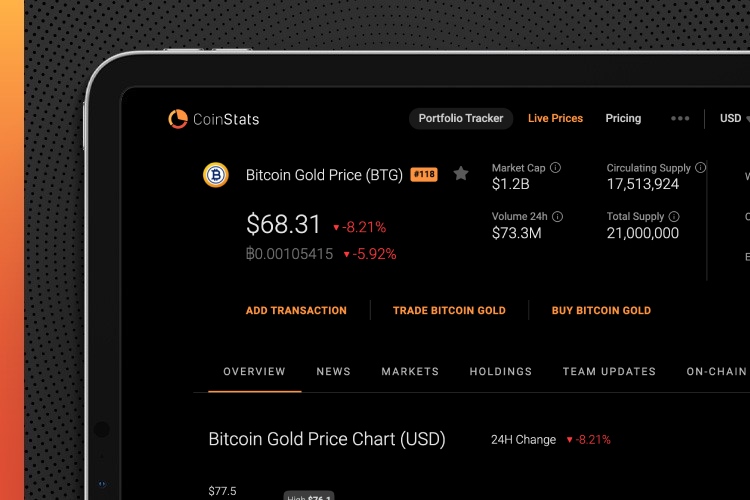

CoinStats is one of the best crypto platforms around. It allows you to check current market prices, along with in-depth information on several of the biggest and fastest-growing cryptocurrencies.

CoinStats is a cryptocurrency research and portfolio tracker app that provides valuable information and investment advice to help investors make better decisions. Guides and educational blog posts such as BTG price and how to buy Bitcoin on Coinstats are highly recommended for investors.

All you have to do is create an account on the platform, search for Bitcoin Gold in the search section, and choose to buy or trade BTG.

When buying crypto, you should ensure that you fully understand the legalities and risks involved, including currency exchange rate fluctuations. If you are unsure, seek independent financial, legal, tax, and/or accounting advice.

Here are some key points to consider at all times:

It’s not a great plan to buy crypto if you’re only doing so because you’re scared you’ll miss out. Panic buying rarely works out well, and we simply don’t know what will happen to crypto prices in the future.

To find an exchange that meets your basic requirements, you need to consider several features, such as security, liquidity, fees, transparency, legal aspects, technology, and user experience.

Before investing in coins, it’s essential to look meticulously into the history of the networks and the identity of the founders. Take the time to explore the project’s white paper. It should tell you everything about the developers’ aim, including a timeframe, a general overview of the project, and specifics.

One of the primary goals of Bitcoin Gold has been “re-decentralizing” Bitcoin and making a more accessible digital asset that could be more fairly and efficiently distributed among small miners. In so doing, it changed the algorithm from Bitcoin’s SHA-256 hashing algorithm to Equihash-BTG. As a result, the Bitcoin Gold mining process can be run on standard computer systems as fast as on specialized equipment.

Bitcoin Gold’s developers also focused on protection and transparency issues. Unlike Bitcoin, Bitcoin Gold sought to increase anonymity by not publishing transaction details or wallet addresses.

However, smaller proof-of-work blockchains like Bitcoin Gold are particularly susceptible to 51% attacks. The blockchain has endured three 51% attacks and multiple BTG wallet thefts.

The smaller a proof-of-work blockchain is, such as Bitcoin Gold, the more susceptible it is to 51% attacks. In the blockchain, a 51% attack is where the attacker seeks to gain control of 51% or more of the blockchain’s computing power or hash rate.

Bitcoin Gold has faced several attacks in the past, the most recent of which occurred in January 2020, seeing a total of 29 blocks re-organized and more than $70,000 worth of BTG stolen through double-spend attacks.

The first attack occurred in May 2018, leading to the platform’s official delisting from a major crypto exchange platform: Bittrex. The developers of Bitcoin Gold responded by updating their mining algorithm to one they called Equihash-BTG.

After reaching its all-time highest value of over $474 in December 2017, Bitcoin Gold entered a near-perpetual downtrend, falling to $260 at the end of 2017, then to $12.64 at the end of 2018 $5.41 at the end of 2019. Overall, Bitcoin Gold had lost more than 98% of its value in just two years.

However, as Bitcoin blows past the $55,000 milestone once again in October 2021, it is bringing Bitcoin Gold along with it.

In addition to buying BTG as a long-term investment, when you wait for the BTG price to rise so you can sell your crypto coins on an exchange, you can also trade it.

You need a contract for difference (CFD) on a particular cryptocurrency and speculate on the BTG price difference. You can either hold a long position (speculating that the price will rise) or a short position (speculating that the price will fall). This is considered a short-term investment as CFDs are usually used within shorter timeframes.

There are differences between buying BTG and trading a CFD in a crypto market. You store the crypto you purchased in a wallet, but when trading CFDs the position is held in your trading account, which is regulated by a financial authority. You have more flexibility when you trade using CFDs because you are not tied to the asset; you are only connected to the underlying contract.

To sum up, here are the key benefits of BTG:

Fungibility -1 BTG is equal to 1 BTG at any time. As a fungible digital currency, BTG is identical, replaceable, and convertible.

Decentralization – It’s decentralized and community-driven.

Faster Transactions – It makes for faster transactions as a result of its enhanced design. While Bitcoin produces about 5 Transactions Per Second, Bitcoin Gold is reported to be up to 27 TPS.