Analysts: Gold Transactions Fu...

29 November 2024 | 1:04 am

Bitcoin has become a powerful cryptocurrency and has even become synonymous with cryptos as a lot of people refer to bitcoin as cryptocurrency. Over the years, it has become. a force to reckoned with in the modern world. So, the question that a novice buyer will have on there is, “How to buy bitcoin” and for this question, we have the answers below.

If you have never invested in Bitcoin because it seems complicated. Here’s a step-by-step guide that tells you all you need to know about how to invest in Bitcoin.

Having a personal exchange method outside of the cryptocurrency exchange account is recommended. Bitcoin is now so flexible that it is possible to get it through P2P exchange and/or at specialized ATMs.

While Bitcoin is not a physical asset, it is not the best choice of action to brag about one’s holding. Your Bitcoin blockchain can be accessed by anyone who has your private key.

As soon as the public learns about your bulk holdings, some may want to steal your bitcoin by accessing your blockchain through your key. This is why your private key should be kept secret and from the public.

The history of transactions made on the blockchain is made public and it’s accessible to anyone -even you. But users’ information is usually not made public.

The one thing that’s made public is the user’s key, which is shown by the side of the transaction. This makes transactions confidential, however, it is not incognito.

Bitcoin-related transactions are traceable and transparent even more than cash, yet users can still utilize them anonymously. This is a clear distinction between cryptocurrency and other currencies.

There have been many claims by authorities that transactions made on blockchains from one digital wallet to the other can be traced. This is because when a user makes a purchase, it is recorded with the user’s name. And if the bitcoin is sent to another digital wallet, it is traceable.

Most cryptocurrency exchange platforms allow you to hold, buy, and sell cryptocurrency successfully. In most cases, it is recommended that you implement an exchange that makes it easy for you to withdraw your cryptocurrencies to your own digital wallets. However, this feature is not a must in an exchange account.

They are different types of cryptocurrency exchange platforms. The type of exchanges that do not request for its user’s personal information thereby aiding their anonymousness. And the type of exchanges that requires user’s information through Know Your Customer (KYC) platforms. The former was created because of individual sovereignty and they operate on a decentralized means of control. These types of exchanges are prone to illegal activities and are also used in providing services to people without a bank account. These can be refugees or people occupying countries with underdeveloped banking infrastructures. However, the latter is the most common and it is centralized.

Some of these centralized exchanges include Coinbase, Binance, Kraken, and Gate.io. They each offer services suited to tailor the needs of their users. Bitcoin and other altcoins are accessible on Gemini, Kraken, and Coinbases. This trio is arguably the most straightforward crypto-on-ramp in the business as a whole. Binance offers a superior trader and a series of cryptocurrency options. More serious trading functions.

It is crucial to remember that secure Internet practices can be used in the creation of a bitcoin exchange account. This requires two-factor verification and a strong and lengthy password. One that incorporates a range of letters, mapped letters, punctuation marks, and digits.

On June 9, 2021, El Salvador made Bitcoin legal tender. This is the first time a country has done so. Any corporation that accepts bitcoin can use it for any transaction. El Salvador’s principal currency is still the US dollar.

Another requirement is to assemble your personal paperwork once you’ve decided how much bitcoin you want to buy. These may entail photos of your license or Social Security details. As well as details about your employment and income information, depending on the exchange.

The information you’ll need is likely to be dependent on the location you reside in as well as the regulations that protect it. This technique is quite equivalent to creating a normal brokerage account.

Therefore, you will now be capable of connecting a payment method when the exchange platform has verified your identification and validity.

Numerous exchanges make it possible to link your financial institution or credit cards or debit cards directly. Although you may buy bitcoin using your credit card, we advise that you entirely avoid that mistake. This is because of the unpredictability that cryptocurrencies might face.

Despite the fact that Bitcoin is a legitimate entity in all 50 States of the US, some financial institutions are skeptical of the concept. They may query or even decline to make deposits to bitcoin websites or exchanges. It’s a smart decision to accurately assess if your financial institution permits payments at the exchange you’ve chosen.

Payments made using bank transfers, credit cards, or debit cards have different costs. Coinbase is an excellent exchange for newcomers, with a charge of 1.49% for bank transfers and 3.99% for card payments. It’s crucial to learn about the costs connected with each method of payment. Do this before selecting an exchange platform or whichever payment method is ideal for oneself.

Exchanges may issue transaction fees. Note that this charge might be a fixed amount, that is if the number traded is minor, or a portion of the total trade.

You might then purchase bitcoin after choosing a reliable exchange and linking one or more means of payment. Over the years, cryptocurrency exchange platforms have witnessed a considerable amount of growth by becoming more widespread.

Looking at the revenues and functionality, they have gradually expanded. The improvements in bitcoin exchange operations align with the switch in public opinion of bitcoins. An enterprise that was previously depicted as a fraud, albeit one with dubious means has experienced an overhaul that has converted it into a genuine one.

All the banking and finance industry’s major players are becoming more inclined towards the cryptocurrency landscape. Click here to read more.

Cryptos have gotten to the point that they offer the same functionality as their stockbroking equivalents. You are all set to proceed once you’ve located an exchange platform and connected a method of payment.

Today’s modern crypto exchanges offer a plethora of trading platforms, including investment opportunities. Most cryptocurrency exchanges allow limit and market orders, with some additionally accepting stop-loss orders.

Wallets for bitcoin and other cryptocurrencies offer a secure way to store virtual currencies. Saving your bitcoin in a personal bitcoin wallet rather than being on an exchange means that you’re the only one who can access your funds’ private key. Also, it provides the opportunity to keep funds outside of an exchange, which mitigates the danger of your assets being stolen in case the exchange wallet is compromised.

Despite the fact that almost all exchanges provide crypto wallets for their consumers, encryption is unfortunately not their main concern. For significant or lengthy bitcoin holdings, we don’t suggest utilizing an exchange platform.

Many wallets have quite a greater number of features than others. A few are Bitcoin-only, while others make room for you to save a wide range of cryptocurrencies. Furthermore, some wallets accept the exchange of one currency for another. You get a variety of alternatives when you have to choose the perfect Bitcoin wallet for you.

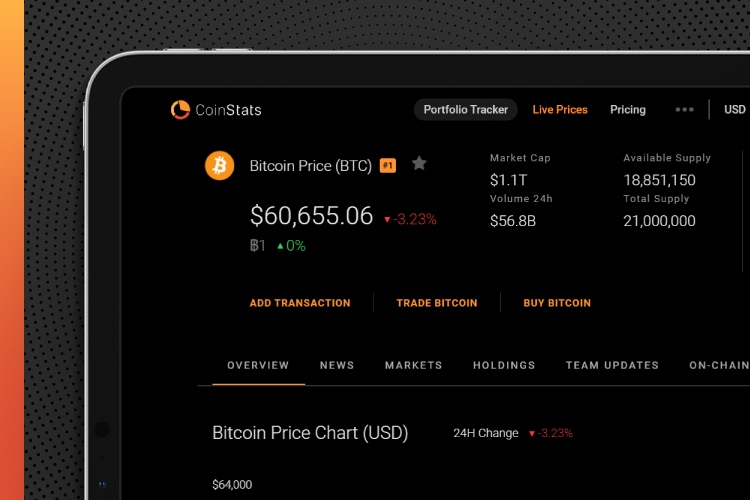

Coinstats is more than just a platform where you can research and learn about coins and vital financial statistics.

You can also buy coins there! All you have to do is create an account on the website, search for Bitcoin and click on Trade Bitcoin.

You can make payments via Apple Pay and or your regular debit card, although this option is restricted to US-based users.

Although exchanges such as Coinbase and Binance are still one of the most common methods to buy bitcoin or sell Bitcoin, these are far from the only option. Other procedures used by Bitcoin users are listed below.

Bitcoin ATMs function similarly to Bitcoin trades in person. Anyone may put money into a device and buy Bitcoin, which is later moved to an encrypted virtual wallet. you can also use this method to sell bitcoin. Bitcoin ATMs have gained popularity in recent times, and Coin ATM Radar will help you find the nearest ones.

Unlike cryptocurrency applications, which privately connect sellers and buyers. Which also handles all elements of the transaction, some peer-to-peer platforms allow users to talk to one another. A good example of this type of exchange is LocalBitcoins. Clients may submit requests to purchase or sell Bitcoin cash upon registering an account. This is after providing methods of payment and pricing information.

Many parts of the exchange are simplified by LocalBitcoins. P2P exchanges cannot provide an equal degree of confidentiality as decentralized exchanges.

In conclusion, buying bitcoin has never been easier or more convenient for customers around the world, it had become fast, easy and secure. Bitcoin cash has gone as far as becoming the legal tender in a country and is wildly recognized worldwide. We hope this article would have taught you how to buy bitcoin.