Faith Rekindled: El Salvador B...

25 February 2025 | 5:30 pm

The post Crypto Market Might See One Last Major Crash – Predicts Bloomberg Analyst appeared first on Coinpedia Fintech News

The Fed, the ongoing crypto winter, and the FTX collapse have all begun to erode investor confidence in the market. While everyone waits for a trend reversal, one analyst predicts what will happen to the cryptocurrency sector next.

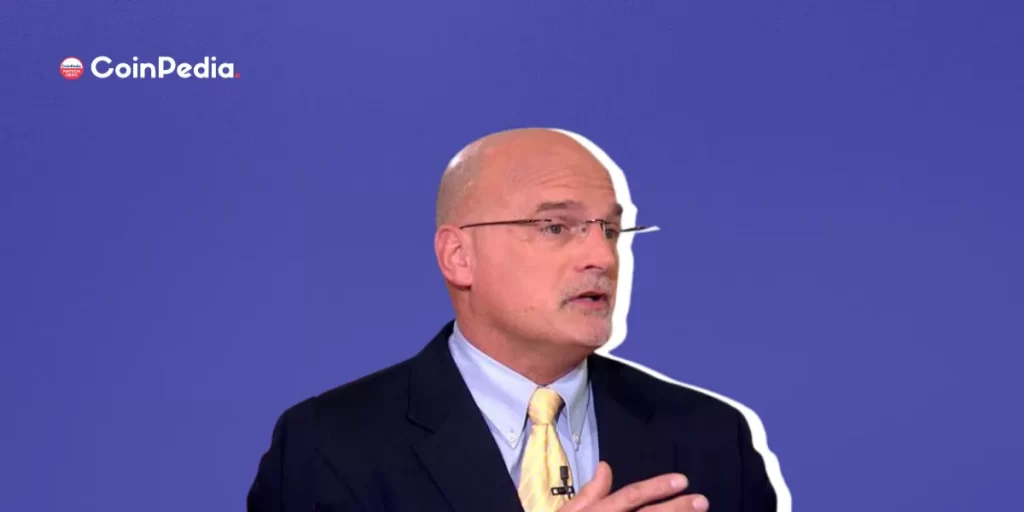

According to Mike McGlone, who is a commodity strategist for Bloomberg, the reversal of the trend in the cryptocurrency market may take some time to happen. He said that the worst of the crypto winter is probably behind us.

In a recent interview with Stansberry Research, He said that we might be in the final stages of the ongoing bear market, and typically such bear markets according to him will ‘make you lose your hair and take money from everybody and they will be volatile and difficult.’

“Cryptos have already backed up 80%, and you just don’t want to get too bearish when a thing is down 80%,” he advised.

He said that this is not a crypto winter and added that it’s a ‘everything winter’ but except for one asset class. “This an everything winter, except for one asset class. Those are commodities. Commodities have to go down. If they don’t, the Fed is going to keep tightening until they do, and so that that’s to me the way I look at it.”

Talking about the second-largest cryptocurrency, McGlone recalled the time when Ethereum was trading at $100 at the end of 2019. Ethereum will grow because of the strong foundation of the smart contract platform, according to him. He said that the currency is still 12X up and it is holding good support at $1000.

“I fully expect that to come out ahead and to continue that upward trajectory over time,” he added

“The key thing to remember… Bitcoin and Ethereum, the two stalwarts in the space have declining and definable diminishing supply, and increasing adoption and demand.I fully expect the adoption point to increase after bumps in the road, and prices have to go up over time,” he concluded.