The AI Agent Token Bubble: Why...

22 January 2025 | 6:30 pm

On July 20, the CEO of Circle Internet Financial LLC., Jeremy Allaire, published a blog post that explains the firm’s dollar-pegged stablecoin is backed by “prioritized trust, transparency, and accountability.” Allaire’s blog post follows a letter from the Centre Consortium’s accountant, Grant Thornton explaining that the stablecoin’s reserve account information matches the accompanying reserve account report, which is “correctly stated.”

At the end of May, the cryptocurrency community started discussing the stablecoin usd coin (USDC) as the project’s reserve backing attestations were running late. At the time, USDC’s token issuance was swelling rapidly and at the end of the month, the Centre Consortium partner Coinbase revealed interest-bearing USDC accounts with 4% APY.

A few days later, Circle disclosed that the project expanded to the Tron network, and plans to reside on ten different blockchains. At the time of writing, USDC is the second-largest stablecoin under tether (USDT), as the market valuation commands $26.72 billion in value on Tuesday. At press time, 30-day statistics show USDC in circulation on July 20, 2021, is 10% higher than the latest attestation, as the reserve report only covers USDC accounting until the end of May.

In the blog post published on Tuesday, Allaire says that Circle and the Centre Consortium have ensured the “pillars of trust” so the public understands that USDC remains backed on a 1:1 basis with dollar-denominated assets. Allaire’s blog post stresses that the “pillars of trust” include:

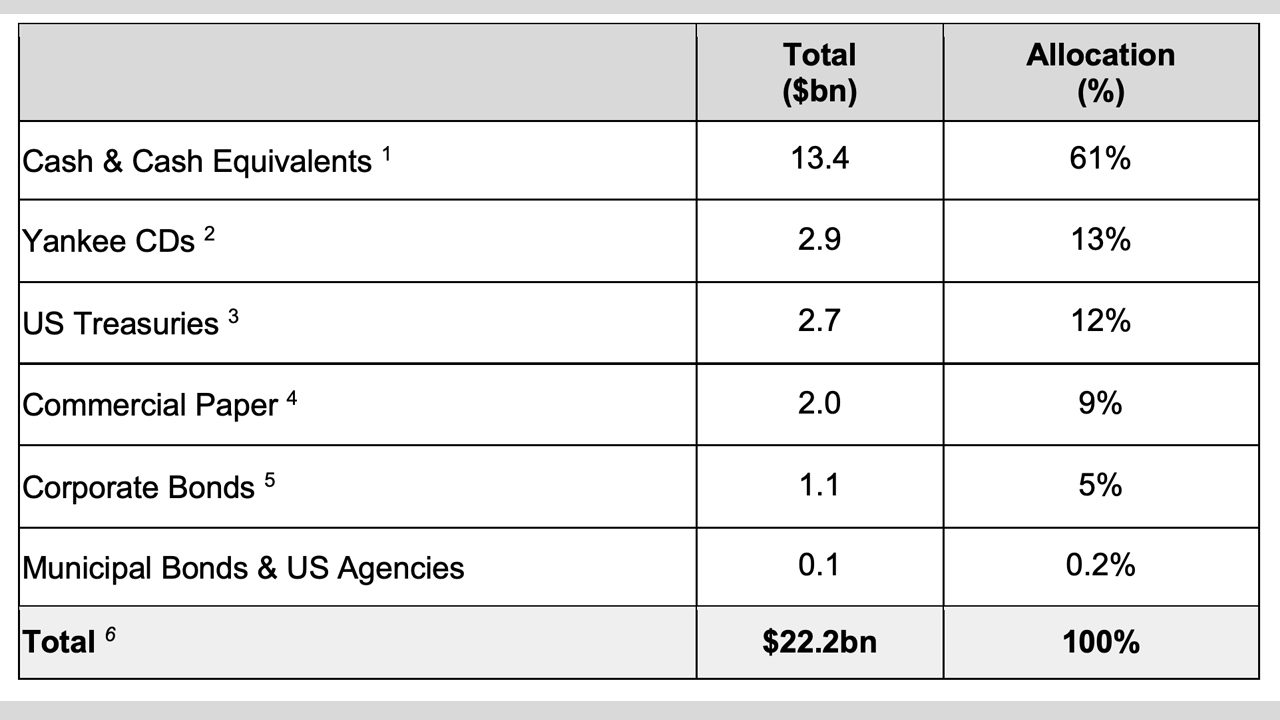

Circle’s attestation and the letter from Grant Thornton gives the public a perspective on how the USDC backing is actually calculated. While a majority of USDC backing is made up of cash, USDC backing also includes fractions of corporate bonds, U.S. Treasuries, and Yankee Certificates.

Globally, Grant Thornton is the seventh-largest by revenue operating as an independent accounting firm. The London company’s letter concerning USDC reserves notes that as of May 28, 2021, there was approximately 22,176,182,251 USDC in circulation. Grant Thornton’s letter states:

The total fair value of U.S. dollar denominated assets held in segregated accounts are at least equal to the USDC in circulation at the report date.

Allaire also details in his blog post that the latest attestation keeps records of a breakdown of dollar-denominated assets. “With this latest reserve attestation, we are now including a breakdown of dollar-denominated reserve assets, which are all held in the care, custody and control of U.S. regulated financial institutions and in line with laws and guidelines from our U.S. state money transmission regulators,” the Circle CEO noted.

“As we continue our journey to becoming a public company,” Allaire’s blog post concludes. “We will have increasing opportunities for greater transparency, accountability and disclosure around our broader business and operations. Altogether, this expanding public accountability can help to strengthen trust in Circle, USDC and companies building on the standards and market infrastructure that we have been delivering over the past several years.”

What do you think about Circle’s blog post, the letter from Grant Thornton, and the stablecoin’s latest reserve attestation? Let us know what you think about this subject in the comments section below.